Brussels / New Delhi / London — In the wake of a fraught week of diplomacy highlighted by U.S. President Donald Trump’s controversial Greenland rhetoric and threatened tariffs on European allies, the European Union has accelerated strategic trade partnerships with India and deepened cooperation with the United Kingdom and China, reshaping global trade alliances in early 2026.

EU–India Landmark Free Trade Agreement

On January 27, 2026, the European Union and India finalized a historic Free Trade Agreement (FTA) after nearly two decades of negotiations, in what EU leaders are calling the deal as:

“mother of all deals.”

Von der Leyen said after landing in Delhi, where she met the Indian prime minister, Narendra Modi, on Tuesday:

“Europe and India are making history today.”

She further added:

“We have concluded the mother of all deals. We have created a free trade zone of 2 billion people, with both sides set to benefit.”

The pact, hailed as the most ambitious trade opening India has ever granted, was concluded amid heightened global economic turbulence triggered in part by renewed U.S. protectionist actions under President Trump. The agreement provides for the elimination or sharp reduction of tariffs on roughly:

“96–99% of goods traded between the EU and India over several years.”

This range from automobiles, machinery, wines, and spirits to Indian textiles, marine products, and chemicals. European Commission President Ursula von der Leyen described the deal as a strategic partnership, not merely a commercial arrangement, securing access to one of the world’s fastest-growing markets and reducing reliance on both U.S. and Chinese supply chains.

While the pact still requires ratification by the European Parliament, EU member states, and India’s cabinet, its expected implementation in 2026–27 could double EU strategic exports to India by 2032, edging around €4 billion in tariff savings.

Up to 250,000 European-made vehicles will ultimately be able to enter India at a preferential duty rate, far outstripping the 37,000 limit allowed from the UK, agreed in a separate deal last year. India has also agreed to gradually reduce tariffs on European wines and spirits to 20% to 40%, down from the current rate of 150%. Duties on olive oil and processed foods, such as pasta and chocolate, will be cut to zero.

UK–India and EU–UK Engagements Parallel the Shift

The United Kingdom and India have already formalized their own Comprehensive Economic and Trade Agreement (CETA) in July 2025, an arrangement that reduced tariffs, boosted bilateral investment, and forecasted billions in economic gains. This UK–India deal, negotiated after Brexit, was seen as a diplomatic signal of London’s intention to diversify its global economic footprint just as European trade realignment accelerates.

In parallel, the EU and UK continue to coordinate on trade policy coherence, including discussions on harmonized approaches to China and broader Indo-Pacific economic strategies, even as they maintain mutual cooperation frameworks in services, technology trade, and regulatory standards.

Brussels and New Delhi have faced a barrage of tariffs from US President Donald Trump, who has imposed levies of up to 50% on the country’s purchases of Russian oil. Last week, Trump threatened EU countries with additional tariffs if they opposed his ambitions to control Greenland.

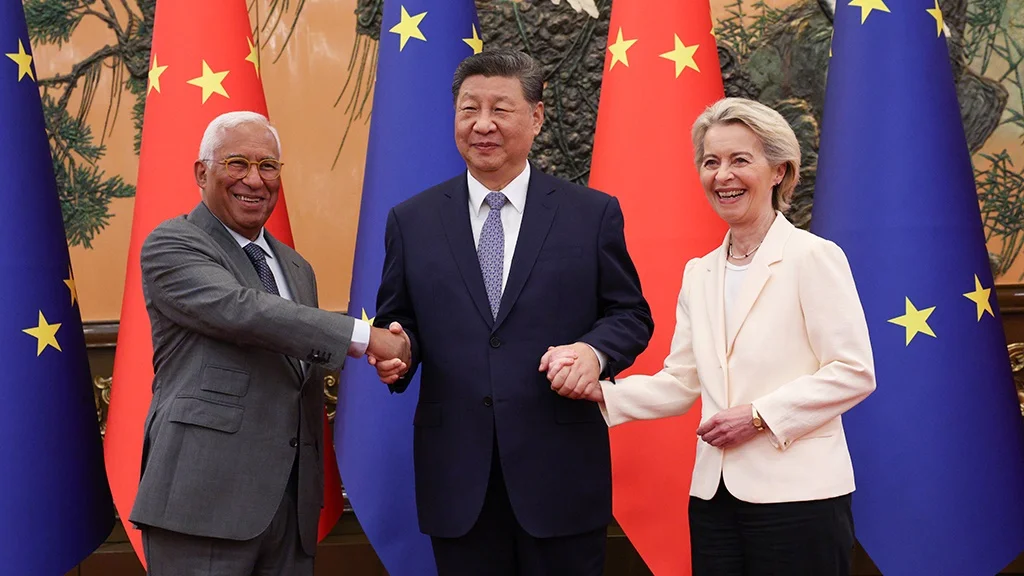

EU–China Relations: Trade Frictions and Strategic Engagement

Relations between the European Union and China exhibit a complex mix of cooperation and competition. China remains one of the EU’s largest trading partners, supplying electronics, machinery, and autos, even as bilateral trade deficits and retaliatory tariffs complicate the relationship. Last year’s anti-subsidy duties imposed by Beijing on EU dairy products, and reciprocal EU tariffs on Chinese electric vehicles, illustrate a tit-for-tat trade dynamic.

Despite this, high-level visits between European and Chinese leaders continued throughout 2025, showing an ongoing investment in dialogue on economic cooperation, supply chain integration, and climate commitments.

The strategic pivot toward India and enhanced UK coordination does not imply a decoupling from China, but rather a broader diversification strategy aimed at balancing dependencies amid geopolitical uncertainty. European policymakers have emphasized the need to manage competition with China while deepening cooperative links where mutual interests align, particularly in technology, green energy, and standards-based trade.

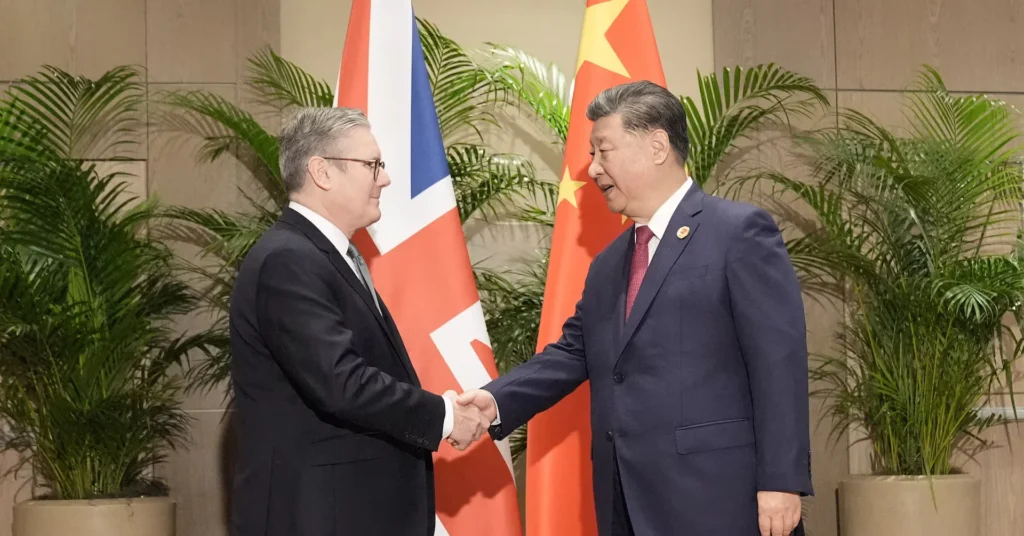

UK Prime Minister Keir Starmer Historic China Visit

British Prime Minister Sir Keir Starmer has commenced a high-stakes diplomatic and economic visit to China, marking the first trip by a U.K. premier to Beijing in eight years. The mission, which began on 28 January 2026, aims to strengthen trade ties, expand business opportunities for British firms, and navigate complex geopolitical tensions between China, the United States, and the United Kingdom.

Starmer arrived in China with a large delegation of more than 50 business leaders, representing sectors from finance to automotive and services, signalling a clear priority on economic engagement with the world’s second-largest economy. Starmer said upon arrival:

“We’re here to deliver for the British people and explore opportunities with Chinese partners.”

Starmer’s four-day visit, which includes meetings with President Xi Jinping and Premier Li Qiang, focuses on:

- Expanding bilateral trade and investment, particularly in services, finance, and green technology.

- Exploring easing visa restrictions and fostering mobility for business and cultural exchanges.

- Discussing practical cooperation on climate, health, and economic stability, amid shared global challenges.

- Managing diplomatic differences over issues such as human rights, cyber threats, and geopolitical tensions.

Suggesting a cautious but constructive dialogue, both the U.K. and Chinese governments have signalled a commitment to:

“seek common ground while managing differences.”

Following China, Starmer is scheduled to engage in further diplomatic travel, including talks with Japanese leadership, indicating a sustained global diplomatic push in Asia amid evolving strategic priorities.

Transatlantic Strain and Trump’s Greenland Dispute

These developments unfold against a backdrop of recent tension between Europe and the United States. Earlier in January, President Trump’s assertive stance on Greenland’s strategic role in Arctic security, coupled with threats to impose tariffs on EU and NATO allies that opposed his policy, strained ties with European capitals.

While Trump ultimately backed down from imposing the tariffs, the episode spotlighted diminishing trust and fueled European momentum to pursue independent trade and security strategies. The Greenland issue also contributed to the suspension of a proposed EU-U.S.

“Agreement on Reciprocal, Fair and Balanced Trade.”

Many in Brussels had hoped would advance transatlantic economic integration. Starmer’s China visit also follows similar diplomatic trips by European leaders, reflecting broader shifts in global strategy and trade realignment. That suspension highlights how geopolitical flashpoints can derail longstanding negotiations with far-reaching economic implications.

Trump Reaction Over EU-India Trade Deal and Starmer’s China Visit

Trump described the EU–India Free Trade Agreement as “a missed opportunity for the United States” and criticized both the European Union and India for what he framed as

“economic opportunism at America’s expense”

Trump argued that the United States should have negotiated a “better and bigger deal” with India first, accusing both the EU and New Delhi of:

“colluding against U.S. economic interests.”

In comments to reporters in Florida, Trump, once again after Chagos statement, called Starmer’s policy of “engage but guard against risks” as “naïve” and “dangerous” given Beijing’s record on trade barriers and geopolitical assertiveness:

“The UK is making deals with China while America stands strong.”

Trump further added:

“I’ve always said you can do business with China — but you must do it from a position of strength, not supplication. What we are seeing from Europe and the UK is a misreading of China’s intentions.”

Trump said that the United States would not sit idly by as allies deepen economic relations with China, warning that such engagement could undermine efforts to counter unfair trade practices, intellectual property theft, and state-subsidized industries. Trump also framed Starmer’s China visit within a larger geopolitical contest that could weaken NATO cohesion and U.S. leverage in Indo-Pacific affairs, saying Europe and the UK were moving into a:

“strategic gray zone.”

While Trump is not in office, his comments are seen as a signal of broader Republican foreign-policy currents heading into the 2026 election cycle, where trade, China policy, and Western alliances are expected to be pivotal issues.

Why These Deals Matter Now

Analysts say the timing of the EU–India FTA, reinforced UK cooperation, and realigned China engagement reflects Europe’s strategic calculus to:

- Diversify trade dependencies away from singular reliance on U.S. or Chinese markets;

- Bolster economic resilience against unilateral protectionist shocks;

- Secure long-term growth opportunities in Asia’s burgeoning markets;

- Enhance geopolitical autonomy within a fracturing global economic order.

Observers also note that while Starmer reaffirmed the UK’s “strong alliance” with the United States, his engagement with Beijing highlights a more independent British foreign policy posture.

This multi-vector approach is seen as Europe’s response to an era marked by geopolitical competition, trade fragmentation, and the need for resilient, rules-based trade partnerships, making these deals pivotal in shaping global trade architecture in 2026 and beyond.

What Comes Next

The focus now shifts to the ratification and implementation of the EU–India agreement, anticipated domestic legislative debates in EU member states, and potential follow-up frameworks on services, digital trade, and sustainability.

Observers will also watch how China and the United States respond diplomatically and economically to Europe’s growing ties with India and the UK, particularly in areas like defense procurement, critical technologies, and climate-aligned industrial policy. The global tariff imposition by US President Donald Trump brought the EU, India, the UK, and China closer together again.

This has led to cautious re-engagement between these countries. China has expressed a strong interest in deepening economic cooperation with the EU as it criticises the unilateral actions of the US. Global markets and diplomatic capitals alike see these developments as a sign that trade and geopolitical alignments are in flux and that Europe is positioning itself as a central architect of a multi-polar economic future.